Cyprus

The labour market in Cyprus

Each labour market has some peculiarities. It may be tricky for foreigners to fully understand the payment methods, the taxes and other benefits related to them. In TalentUp, we are starting a series of different blog articles, one for each country. This article analyses the Cyprus labour market.

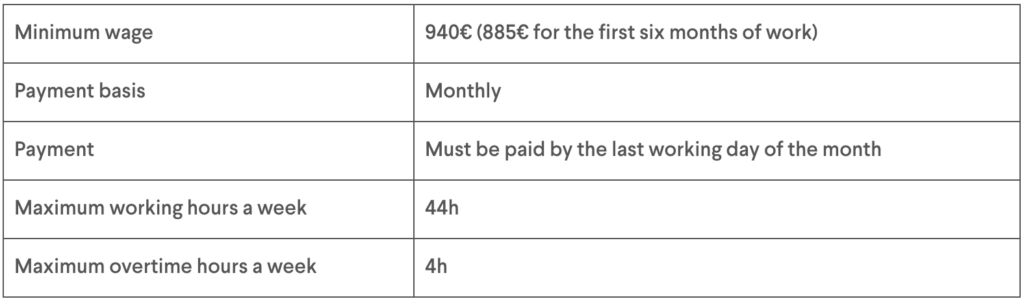

General data about the Cypriot labour market

https://www.papayaglobal.com/countrypedia/country/cyprus/

Payroll taxes in Cyprus

Social security contributions are made by the employer and the employee and are used for funding unemployment, pension, maternity/paternity leave, and sickness or injury.

https://www.papayaglobal.com/countrypedia/country/cyprus/

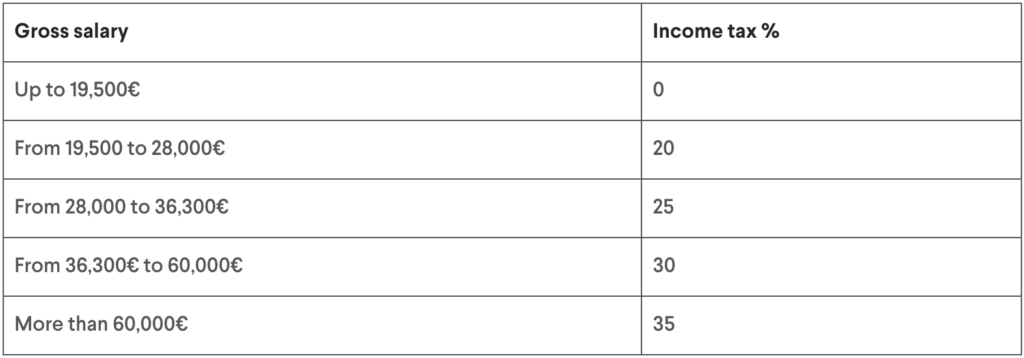

Once contributions are paid, employees need to pay an income tax that varies depending on their gross salaries.

https://www.papayaglobal.com/countrypedia/country/cyprus/

Contingencies from self-employees

As of January 1, 2019, the contributions of self-employed persons were 15.6% of their income. Thereafter, the rate will increase every five years until it reaches 20.4% as of January 1, 2039. The amount of the contributions is subject to a lower and a maximum limit, depending on the profession or trade of the self-employed person. These limits are set on an annual basis.

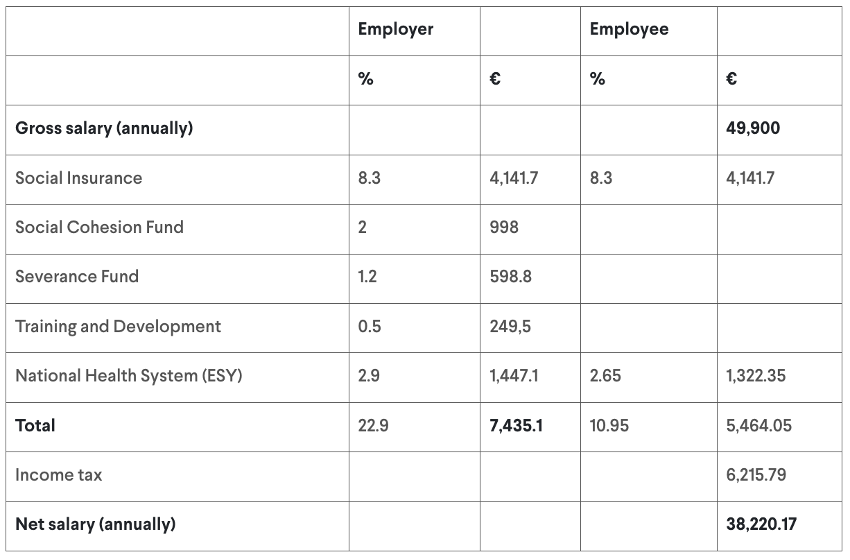

Example of net salary in Cyprus

As a reference, we use the average salary of a software engineer. In Cyprus, on average, software engineers earn 49,000€ annually.

The employer contributes 7,435.1€ to social security, and the employee contributes 5,464.05€.

After paying the income tax, the employee has a net salary of 38,220.17€, coming from a gross salary of 49,900€.

Unemployment regulation in Cyprus

The notice period for a temporary or permanent employee is dependent on the employee’s length of employment:

https://www.papayaglobal.com/countrypedia/country/cyprus/

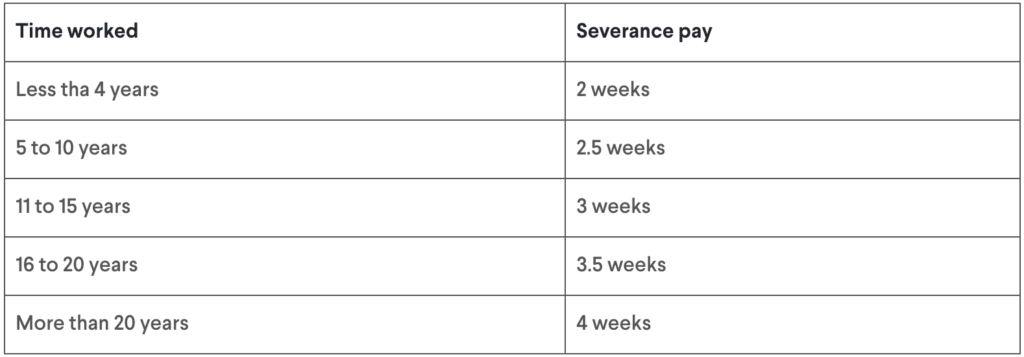

The severance pay varies based on the length of employment:

https://www.papayaglobal.com/countrypedia/country/cyprus/

Probation periods have a minimum length of six months and a maximum length of two years.

Different kinds of leaves in Cyprus

The standard leave entitlement for employees who work a five-day week is 20 days per year, or 24 days per year for employees who work a six-day week. There are 15 public holidays.

From the fourth sick day, employees are eligible for paid sick leave through Social Security. A medical certificate must be sent to Social Security within 48 hours of sick leave starting. Social insurance pays up to 312 days at 60% of salary; it could be more with a dependent family.

Employees are entitled to up to 5 days of paid leave due to a death of a direct family member.

Employees called to perform military service are covered by assimilated insurance (Social Insurance Services).

Paid parental leave

Women get 18 weeks of maternity leave, 22 for twins, and 26 for triplets. 11 weeks are mandatory, often 2 before due date and rest after. A medical certificate for pregnancy and due date is needed for eligibility.

Fathers are entitled to 2 consecutive weeks of paid paternity leave within the 16 weeks following the birth of a child, paid by the Social Insurance Fund at 75.20% of the employee’s regular salary.

Employees who have adopted a child under 12, are entitled to 16 weeks of leave.

Other common Cypriot benefits

How to employ a Cypriot worker

To employ someone in Cyprus, you need to establish your own new legal entity for banking, accounting and payroll services in the Republic of Cyprus.